Who bought the huge $1.26 trillion of new US gov. debt over the past 12 months?

There was strong appetite. Only the Fed shed them. Here’s who bought.

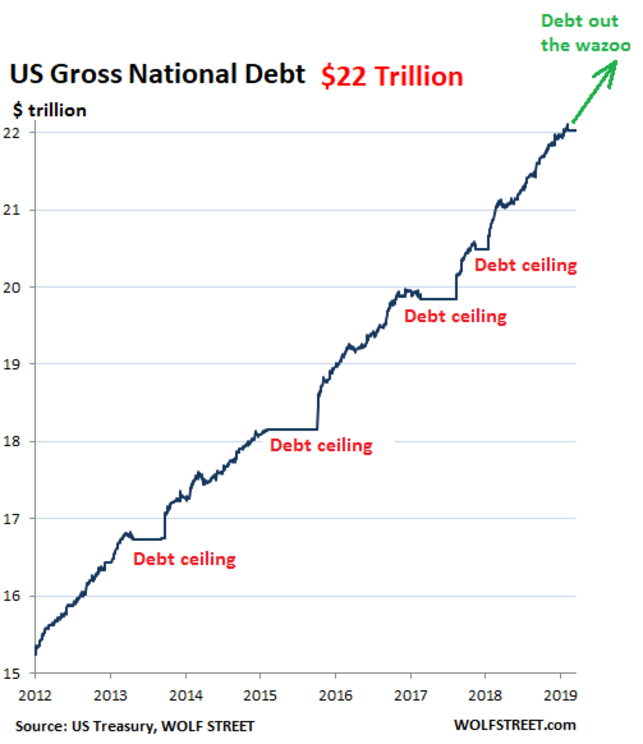

Over the 12 months through February 2019, the US gross national debt ballooned by $1.26 trillion to $22.1 trillion. Someone had to buy this new pile of debt – but who? That question is getting increasingly crucial as this debt is ballooning even in good economic times, fueled by deficits that Fed chairman Jerome Powell consistently calls “unsustainable.” Today, the Treasury Department’s TIC data shed some light on that question.

This US government debt that cost a record $523 billion in interest in fiscal 2018 is an asset for investors – the creditors of the US. The US relies on them to fund its huge deficits.

The foreign creditors.

China, the largest foreign creditor of the US, dumped $46 billion of its holdings of marketable Treasury securities over the 12-month period, according to the Treasury Department’s TIC data. But over the last three months, China added to its holdings. Those holdings at the end of February stood at $1.13 trillion (the peak was in February 2016 at $1.25 trillion).

Japan, the second largest foreign creditor of the US, added $13 billion in Treasury securities to its holdings over the 12 months. In January alone, it added $28 billion. Japan’s holdings of Treasuries now stand at $1.07 trillion (having peaked at the end of 2014 at $1.24 trillion ).

For the rest of this article please go to source link below.