Uber discloses 3-yr $10-billion loss from operations

... stalling Rideshare revenue & 50 pages of “risk factors” that are not for the squeamish

But it had big tax benefits and one-time gains. And Uber Eats is hot, so to speak.

Uber Technologies’ IPO filing was made public today. The 330-page or so S-1 filing disclosed all kinds of goodies, including detailed but still unaudited pro-forma financial statements as of December 31, 2018, huge losses from operations, big tax benefits, large gains from the sale of some operations, stagnating rideshare revenues, and an enormous list of chilling “Risk Factors” that go beyond the usual CYA.

The filing, however, didn’t disclose the share price, the IPO valuation, and how much money the IPO will raise for Uber. On Tuesday, “people familiar with the matter” had told Reuters that Uber plans to raise $10 billion in the IPO. Most of the IPO shares would be sold by the company to raise funds, and a smaller amount would be sold by investors cashing out, the sources said.

The filing did not confirm this and instead left blanks or used placeholder amounts. But if true, $10 billion in shares sold would make this IPO one of the biggest tech IPOs. And the rumored $90 billion to $100 billion valuation would make it the biggest since Alibaba’s $169 billion IPO.

Uber will need every dime it raises in the IPO going forward because it’s got a little cash-burn situation in its operations that persists going forward, as it admitted in its “Risk Factors,” and it will need to raise more money, and if it cannot raise more money, it might not make it. Uber is upfront about this.

The company has already raised – and mostly burned through – over $20 billion so far in its 10 years of existence. This includes $15 billion in equity funding and over $6 billion in debt.

For the IPO, Morgan Stanley and Goldman Sachs are the lead underwriters, followed by an additional 27 underwriters. So in the future, expect brilliantly glowing rave-endorsement by analysts at these 29 institutions.

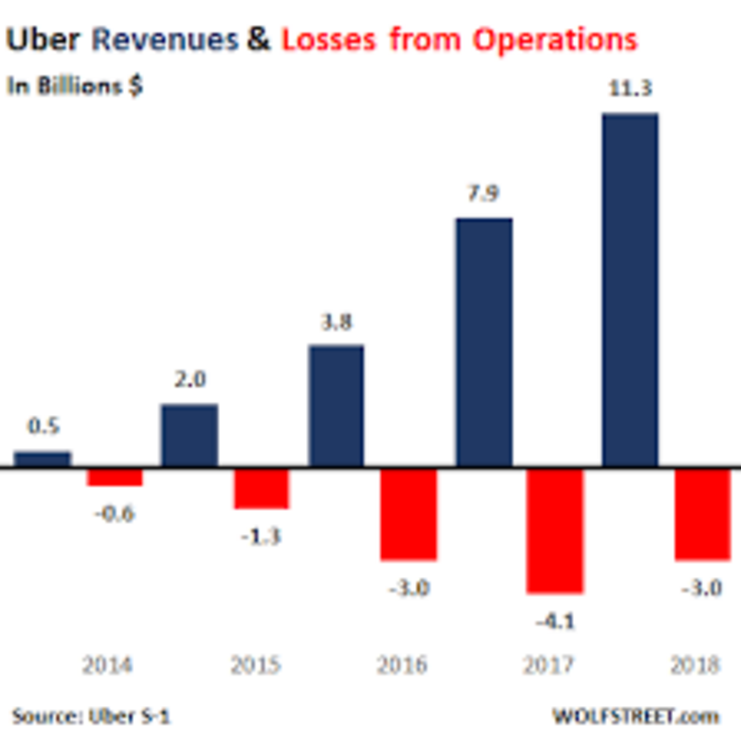

Uber’s rideshare revenues skyrocketed from $495 million in 2014 to $11.3 billion in 2018. But losses from operations have also skyrocketed. In 2017, these losses from operations hit $4 billion, over half the company’s revenues. In 2018, losses from operations were $3 billion. Over the past three years, these losses from operations added up to $10.1 billion:

The company also sits on $6.4 billion in cash, and if it raises $10 billion in new money in the IPO, it won’t run out for a while.

But revenue growth slowed last year: In Q4, total revenues at $2.974 billion were just 1% up from Q3 ($2.944 billion). Despite quarter-over-quarter stagnating revenues, the loss from operations jumped from $763 million in Q3 to $1.05 billion in Q4.

Even for the whole year, rideshare revenue growth bogged down. The growth was at food-delivery service Uber Eats. These are Uber’s “Core Platform” revenues for 2018:

- Rideshare revenues inched up 7.1% to $9.18 billion

- Uber Eats revenue jumped 148% to $1.46 billion

- Vehicle Solutions revenues plunged 59% to $143 million

- Other revenues jumped 149% to $112 million

Revenues from Uber Freight and Uber’s e-scooter and e-bike share programs booked $225 million in revenue.

Uber laments how its market share has gotten hit, particularly in the US and Canada, where series of hair-raising scandals shook the company:

Our category position has declined in certain geographies in recent periods. In 2017 our category position in the United States and Canada was significantly impacted by adverse publicity events.

Our ridesharing category position generally declined in 2018 in the substantial majority of the regions in which we operate, although at a slower rate.

We believe our category position is also impacted by heavy subsidies and discounts by our competition. Well-capitalized competitors, many of which took advantage of the adverse publicity we experienced in 2017 to improve their category positions, have pressured and may continue to put pressure on our margins as they are able to fund lower fares, service fee reductions, and consumer discounts and promotions to enter new markets and grow their category position.

So there may be a revenue problem in its rideshare division, and there is a cash-burn problem in its operations overall, but below the line all kinds of good things happened, even if the biggies just happened one time:

In 2018 alone, Uber booked net gains of $4.99 billion below the line:

- A gain of $3.2 billion, including from selling some of its operations to Yandex and Grab;

- An “unrealized gain on investment” of $2.0 billion;

- Interest income of $104 million

- “Other” income of $225 million

- A loss due to “change in fair value of embedded derivatives” of $500 million

- A loss of $45 million due foreign currency exchange of $45 million

It also booked a tax benefit of $282 million and interest expense of $648 million. These below-the-line-gains, expenses, and tax benefits turned its $3 billion loss from operations into a net income of about $1 billion.

In 2017, Uber didn’t have those kinds of massive below-the-line gains, except for a juicy $542 tax benefit. This tax benefit lowered its loss from $4.6 billion to a net loss $4.03 billion.

The “Risk Factors” are not for squeamish

The huge section of about 50 densely filled pages of “Risk Factors” contains the usual warnings about the things that might happen to the company that are typical in IPO filings. These items are a CYA exercise. If you get wiped out and sue the company or the underwriters, they will point you to the correct paragraph and tell you that you should have read this, and that if you had read this you would have known that you’d get wiped out, or something.

But Uber’s list contains all kinds of other stuff that is unique to the scandal-infested company that is defending itself in court on numerous life-threatening issues.

So here are a few of the key headlines of risk factors. Each headline comes with a long explanation that I will spare you. The bold is my heading. The indented text is the quoted headline from “Risk Factors”:

This is an example of the standard CYA:

The personal mobility, meal delivery, and logistics industries are highly competitive, with well-established and low-cost alternatives that have been available for decades, low barriers to entry, low switching costs, and well-capitalized competitors in nearly every major geographic region. If we are unable to compete effectively in these industries, our business and financial prospects would be adversely impacted.

Uber may never become profitable:

We have incurred significant losses since inception, including in the United States and other major markets. We expect our operating expenses to increase significantly in the foreseeable future, and we may not achieve profitability.

The contractor v. employee issue could sink Uber:

Our business would be adversely affected if Drivers were classified as employees instead of independent contractors. The independent contractor status of Drivers is currently being challenged in courts and by government agencies in the United States and abroad.

The effects of the scandals:

Our workplace culture and forward-leaning approach created operational, compliance, and cultural challenges, and a failure to address these challenges would adversely impact our business, financial condition, operating results, and prospects.

And:

Maintaining and enhancing our brand and reputation is critical to our business prospects. We have previously received significant media coverage and negative publicity, particularly in 2017, regarding our brand and reputation, and failure to rehabilitate our brand and reputation will cause our business to suffer.

Investors may get wiped out:

We may experience significant fluctuations in our operating results. If we are unable to achieve or sustain profitability, our prospects would be adversely affected and investors may lose some or all of the value of their investment.

Uber expects slowing growth, but it could get worse:

If our growth slows more significantly than we currently expect, we may not be able to achieve profitability, which would adversely affect our financial results and future prospects.

Everything hinges on Uber’s autonomous vehicle strategy:

If we fail to develop and successfully commercialize autonomous vehicle technologies or fail to develop such technologies before our competitors, or if such technologies fail to perform as expected, are inferior to those of our competitors, or are perceived as less safe than those of our competitors or non-autonomous vehicles, our financial performance and prospects would be adversely impacted.

Uber will burn all its cash, and if it can’t raise more, it’s over:

We will require additional capital to support the growth of our business, and this capital might not be available on reasonable terms or at all.

The user data Uber collects can sink Uber if it gets hacked:

If we experience security or data privacy breaches or other unauthorized or improper access to, use of, or destruction of our proprietary or confidential data, employee data, or platform user data, we may face loss of revenue, harm to our brand, business disruption, and significant liabilities.

The operational metrics Uber provides may be fake:

We track certain operational metrics and our category position with internal systems and tools, and our equity stakes in minority-owned affiliates with information provided by such minority-owned affiliates, and do not independently verify such metrics. Certain of our operational metrics are subject to inherent challenges in measurement, and real or perceived inaccuracies in such metrics may harm our reputation and negatively affect our business.

Those billions in losses may go to waste:

Our ability to use our net operating loss carryforwards and certain other tax attributes may be limited.

Pray for acquisitions:

If we are unable to identify and successfully acquire suitable businesses, our operating results and prospects could be harmed, and any businesses we acquire may not perform as expected or be effectively integrated.

Keep out! Vancouver, Canada, is an example:

We may continue to be blocked from or limited in providing or operating our products and offerings in certain jurisdictions, and may be required to modify our business model in those jurisdictions as a result.

The scandals are still dogging Uber:

We currently are subject to a number of inquiries, investigations, and requests for information from the U.S. Department of Justice and other U.S. and foreign government agencies, the adverse outcomes of which could harm our business.

Corruption is dogging Uber:

We have operations in countries known to experience high levels of corruption and are currently subject to inquiries, investigations, and requests for information with respect to our compliance with a number of anti-corruption laws to which we are subject.

You may get totally hosed if you buy the IPO shares:

The market price of our common stock may be volatile or may decline steeply or suddenly regardless of our operating performance, and we may not be able to meet investor or analyst expectations. You may not be able to resell your shares at or above the initial public offering price and may lose all or part of your investment.

You won’t have any say:

Concentration of ownership of our common stock among our existing executive officers, directors, and principal stockholders may prevent new investors from influencing significant corporate decisions, including mergers, consolidations, or the sale of us or all or substantially all of our assets.

Uber may blow all this money it’s raising:

We have broad discretion in how we use the net proceeds from this offering, and we may not use them effectively.

Tesla and Panasonic have frozen their expansion and investment plans for the Gigafactory, after deliveries of Teslas plunged in Q1. Read… Carmageddon at Tesla-Panasonic Gigafactory in Nevada and Shanghai