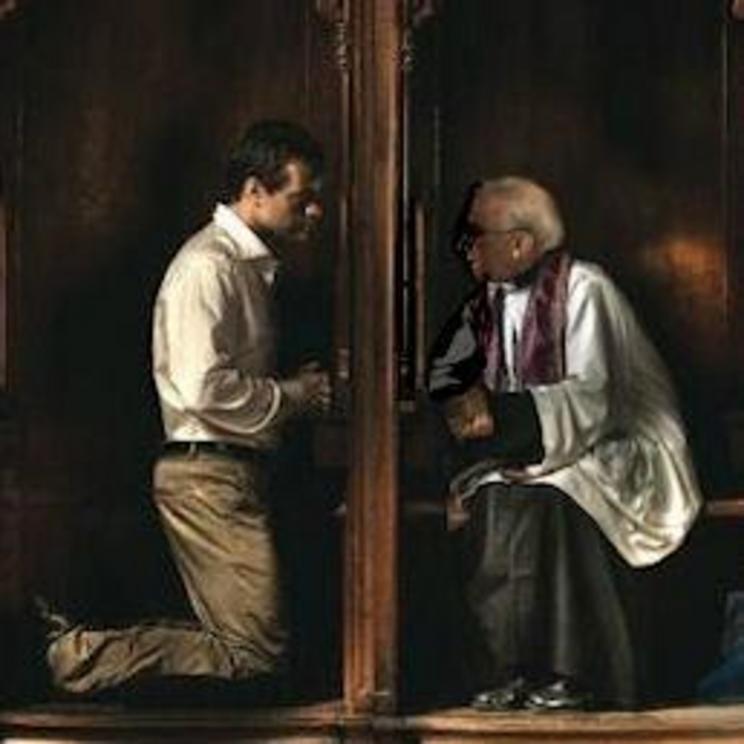

Confession time for big banks in Europe

... Banco Santander reports $12.7 billion loss

Too-Big-To-Fail Santander is also one of the Eurozone’s worst capitalized banks.

By Nick Corbishley, for WOLF STREET:

Banco Santander, Spain’s largest lender and one of the Eurozone’s eight global systemically important banks (G-SIBs), has posted its first ever loss in 163 years of operations. And it was gargantuan. During the first half of the year, the bank racked up a loss of €10.8 billion ($12.7 billion).

The loss was caused by heavy provisions for expected loan losses. This quarter wiped out the equivalent of one-and-a-half years of the bank’s global profits — in 2019, it posted total global profits of €6.5 billion, and in 2018 of €7.8 billion.

The losses were the result of a €2.5 billion charge related to the recoverability of tax deferred assets as well a €10.1 billion write-down on assets across a number of key overseas markets:

- In the UK: €6.1 billion write-down of “goodwill” — amount overpaid for prior acquisitions, which included Abbey National and Alliance and Leicester. Santander already took a €1.5 billion write-down on the value of its UK business last year, blaming new regulations and the expected economic fallout from Brexit.

- In the US: €2.3 billion write-down for Santander Consumer USA, which specializes in consumer lending, particularly subprime lending, and these consumer loans are now particularly at risk.

- In Poland, its largest market in Eastern Europe: €1.2 billion goodwill impairments charge.

- In its consumer finance division, which is present in 15 markets: €477 million hit.

Santander’s shares initially reacted to the news by slumping 5.8%. They then staged a partial recovery, only to slump again, ending the day down nearly 5%. Shares are down an eye-watering 45% this year, making it one of the continent’s worst-performing large financial institutions.

“The past six months have been among the most challenging in our history,” Santander’s Chairwoman Ana Botin said in a statement. “The impact of the pandemic has tested us all.”

Santander isn’t the only major Spanish bank to have reported unprecedented losses since the virus crisis began. In April, BBVA, Spain’s second largest bank, reported its worst ever quarterly loss, amounting to €1.8 billion, after the bank took a €2.1 billion write-down in the United States. In Mexico, its biggest market, BBVA’s profits also plunged 40%. The bank also faces risks in another major market, Turkey.

Santander and BBVA are more exposed to the emerging markets of Latin America than any other global banks. Those markets have provided bumper profits for both lenders since the last crisis. But in the second quarter, Santander Brasil’s earnings fell 41% to $353 million after the bank set aside €530 million to cover potential coronavirus-related loan losses.

Latin America is currently on the front line of the coronavirus pandemic, having recently surpassed 4.4 million infections. This is putting strains on the economies of countries that have neither the fiscal firepower nor monetary leeway to protect businesses and jobs in the same way that has happened in Europe. The major risk is that the region’s rising bankruptcies, surging unemployment and sharply contracting economies could spark another debt crisis. If that were to happen, Spain’s two largest banks’ outsized exposure to the region could serve as a source of contagion into Europe.

In Europe, the banks are once again gearing up for their earnings calls. Like Santander, many will report losses — some of them already have. The British lender Barclays posted an additional £1.6 billion to its credit impairment charges during the second quarter, bringing the total level to £3.7 billion at the end of the first half. Despite that, it still posted a pretax profit for the first half of £1.27 billion pounds, down from £3 billion for the same period a year earlier.

Deutsche Bank surprised investors by reporting a tiny net profit of €61 million in the second quarter as cost-cutting and revenue growth outweighed loan losses due to the virus outbreak. Attention now turns to France’s four G-SIBs, BNP Paribas, Société Générale, Credit Agricole, and Groupe BPCE.

The CEO of BNP Paribas Asset Management, Frédéric Janbon recently warned of the “mother of all recessions” as the fallout from the coronavirus triggers “a very, very substantial drop in activities in pretty much all of the economies in the world.”

Big banks have capital to absorb the losses that are coming. But some have less than others. According to the European Banking Authority, many of the worst capitalized institutions in Europe are in Spain. Almost at the very bottom of the pile is none other than Banco Santander, placing 123rd out of 127. By Nick Corbishley, for WOLF STREET.

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally get why – but want to support the site? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.