Central bank digital currencies are coming - ready or not

The game-changing development could have a profound impact on the banking system. But few people still understand it.

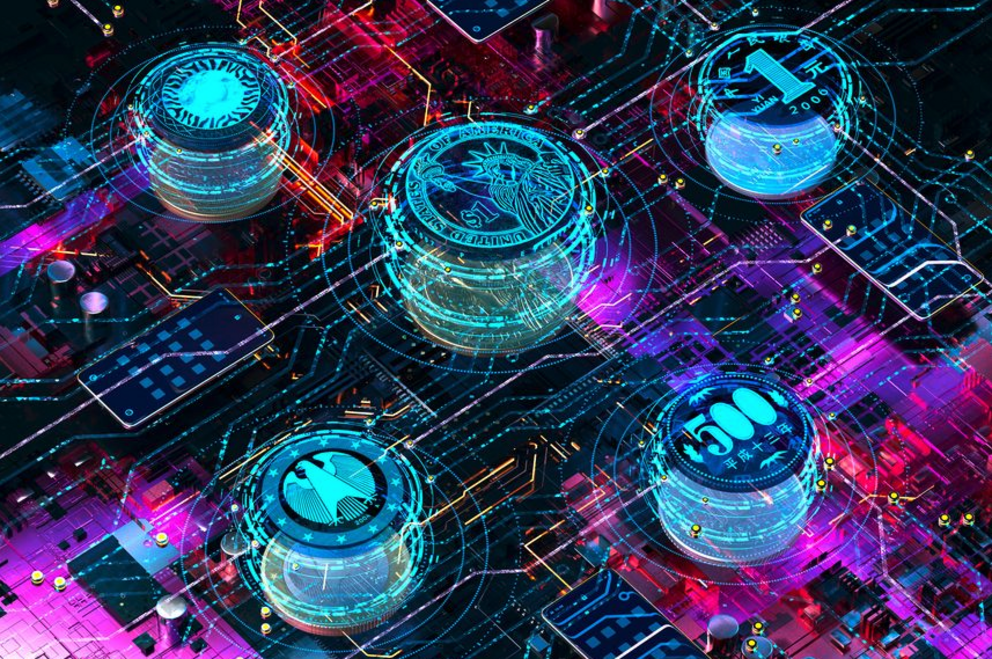

Central-bank digital currencies could lead to big changes in the most basic activity of any banking system: making and distributing money.Illustration: Oliver Burston

“Central-bank digital currency” doesn’t exactly roll off the tongue. But you might want to get used to saying it. These so-called CBDCs, or digital versions of dollars, yuan, euros, yen or any other currency, are coming, say those who study them. And depending on how they are designed and rolled out, their impact on the banking system could be profound.

One hundred and fourteen countries are exploring digital currencies, and their collective economies represent more than 95% of the world’s GDP, according to the Atlantic Council’s Central Bank Digital Currency tracker. Some countries, including China, India, Nigeria and the Bahamas, have already rolled out digital currencies. Others, like Sweden and Japan, are preparing for possible rollouts. The U.S. is studying the issue and has run trials of various technologies to enable a digital currency, although Fed chair Jerome Powell has indicated the U.S. central bank has no plans to create one, and won’t do so without direction from Congress.

Continue reading your article with

a WSJ membership

Special Offer

$2 AUD Per month

For the rest of this article please go to source link below.