2012: Largest known rare earth deposit discovered in North Korea

Privately-held SRE Minerals on Wednesday announced the discovery in North Korea of what is believed to be the largest deposit of rare earth elements anywhere in the world.

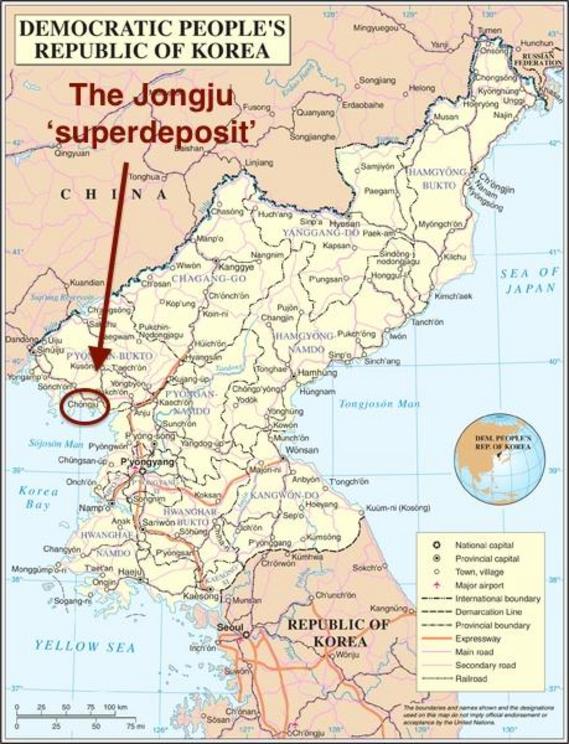

SRE also signed a joint venture agreement with the Korea Natural Resources Trading Corporation for rights to develop REE deposits at Jongju in the Democratic People’s Republic of Korea for the next 25 years with a further renewal period of 25 years.

The joint venture company known as Pacific Century Rare Earth Mineral Limited, based in the British Virgin Islands, has also been granted permission for a processing plant on site at Jongju, situated approximately 150 km north-northwest of the capital of Pyongyang.

The initial assessment of the Jongju target indicates a total mineralisation potential of 6 billion tonnes with total 216.2 million tonnes rare-earth-oxides including light REEs such as lanthanum, cerium and praseodymium; mainly britholite and associated rare earth minerals. Approximately 2.66% of the 216.2 million tonnes consists of more valuable heavy rare-earth-elements.

According Dr Louis Schurmann, Fellow of the Australasian Institute of Mining and Metallurgy and lead scientist on the project, the Jongju deposit is the world’s largest known REE occurrence.

The 216 million tonne Jongju deposit, theoretically worth trillions of dollars, would more than double the current global known resource of REE oxides which according to the US Geological Survey is pegged at 110 million tonnes.

Minerals like fluorite, apatite, zircon, nepheline, feldspar, and ilmenite are seen as potential by-products to the mining and recovery of REE at Jongju.

Further exploration is planned for March 2014, which will includes 96,000m (Phase 1) and 120,000m (Phase 2) of core drilling, with results reported according to the Australia’s JORC Code, a standard for mineral disclosure similar to Canada’s widely used National Instrument 43-101.

The Pentagon recently received what amounts to a grade of F on its efforts to ensure that its suppliers can continue to obtain the rare-earth metals that make possible many of today’s advanced weapons and other technologies. After nearly two decades of Defense Department fecklessness, it’s up to lawmakers to act.

In stark terms, a Government Accountability Office report described how defense officials have failed to meet, and even to identify, their legal and national security obligations with regard to this “bedrock” national-security concern. Instead, defense officials have repeatedly given the all-clear signal to Congress and two administrations.

Depending on when you want to start the clock, this “bedrock” problem is now a teenager or old enough to vote. The last U.S. rare-earth mine ceased mining operations in 1998, the same year that the premiere U.S. rare-earth metallurgist company, Indianapolis-based Magnequench, was essentially sold to members of Deng Xiaoping’s family. Magnequench’s facility was shut down, moved and reopened in China in 2003.

Since then, U.S. defense contractors have become completely reliant on Chinese sources for rare-earth metals, alloys, and magnets—directly or indirectly. The short list of reliable non-Chinese metallurgy companies get all of their rare earth oxides from China and their production is fully committed to Japan and other industrial users. Outside this small circle, there is an even shorter list of financially troubled metallurgical companies that have ongoing quality control issues, limited capabilities, and uncertain economic futures. None of these currently supply U.S. defense contractors. The reality is that all rare earth metallurgy used in U.S. defense systems originates in or must pass through China.

This means that Boeing, Raytheon, General Atomics, Lockheed Martin, Northrop Grumman, General Dynamics, and all of the other primary defense contractors are beholden to China for these critical materials. The contractors themselves have remained quiet on this issue, though they have privately expressed their fear of supply disruption and loss of Chinese contracts if they get on Beijing’s bad side. Control over the supply of critical materials and enormous contracts thereby gives China tangible control over the financial fortunes of the defense industry. Perhaps this also helps explain the Pentagon’s unwillingness to force a solution.

After 2008 the stalled inter-Korean cooperation left North Korea without South Korean financial assistance. Western humanitarian aid has also been exhausted or reduced to a number of goods with little market value. Although the volume of North Korea’s foreign trade is negligible, the domestic economic situation continues to improve. Pyongyang is routinely suspected of violating international sanctions by trading arms, smuggling drugs, counterfeiting US dollars and other crimes. These activities would be expected to refill the impoverished state with badly needed foreign exchange. However, anti-proliferation operations and bank account arrests have never disclosed anything criminal nor did they manage to answer the main question: where does the money come from?

In fact, North Korea is sitting on the goldmine. The northern side of the Korean peninsula is well known for its rocky terrain with 85% of the country composed of mountains. It hosts sizeable deposits of more than 200 different minerals, of which deposits of coal, iron ore, magnesite, gold ore, zinc ore, copper ore, limestone, molybdenum, and graphite are the largest and have the potential for the development of large-scale mines. After China, North Korea’s magnesite reserves are the second largest in the world, and its tungsten deposits are almost the sixth-largest in the world. Still the value of all these resources pales in comparison to prospects which promise the exploration and export of rare earth metals.

Rare earth metals are a group of 17 elements which are found in the earth’s crust. They are essential in the manufacture of high-tech products and in green technologies, such as wind turbines, solar panels or hybrid cars. Known as “the vitamins of high-tech industries,” REMs are minerals necessary for making everything that we use on a daily basis, like smartphones, LCDs, and notebook computers. Some Rare earth metals, such as cerium and neodymium, are crucial elements in semiconductors, cars, computers and other advanced technological areas. Other types of REMs can be used to build tanks and airplanes, missiles and lasers.

South Korea estimates the total value of the North’s mineral deposits at more than $6 trillion USD. Not surprisingly, despite high political and security tensions Seoul is showing a growing interest in developing REMs together with Pyongyang. In 2011, after receiving permission from the Ministry of Unification, officials from the Korea Resources Corp visited North Korea twice to study the condition of a graphite mine. Together with their counterparts from the DPRK’s National Economic Cooperation Federation they had working-level talks at the Kaesong Industrial Complex on jointly digging up REMs in North Korea. An analysis of samples obtained in North Korea showed that the type of rare earth metals could be useful for manufacturing LCD panels and optical lenses.

The joint report also revealed that there are large deposits of high-grade REMs in the western and eastern parts of North Korea, where prospecting work and mining have already begun. It also reported that a number of the rare earth elements are being studied in scientific institutes, while some of the research findings have already been introduced in economic sectors. The North built a REM reprocessing plant in Hamhung in the 1990s but has been unable to put the plant into full operation due to power and supply bottlenecks.

Rare earth minerals are becoming increasingly expensive, as China, the world’s largest rare earth supplier, puts limits on its output and exports. In February China’s exports of rare earth metals exceeded the price of $1 million USD per-ton, a nearly 900% increase in prices from the preceding year. China, which controls more than 95% of global production of rare earth metals, has an estimated 55 million tons in REM deposits. North Korea has up to 20 million tons of REM deposits, but does not have the technology to explore its reserves or to produce goods for the high-tech industry. Nevertheless, in 2009 the DPRK’s exports of rare metals to China stood at $16 million USD, and as long as someone invests, exports will continue to expand.

———–

thanks to maria for the link..

is this the real value of north korea?..very important rare earths ARE required for tech advances..china also has a big hold on REE..

“Rare earth minerals are becoming increasingly expensive, as China, the world’s largest rare earth supplier, puts limits on its output and exports. In February China’s exports of rare earth metals exceeded the price of $1 million USD per-ton, a nearly 900% increase in prices from the preceding year. China, which controls more than 95% of global production of rare earth metals, has an estimated 55 million tons in REM deposits. North Korea has up to 20 million tons of REM deposits”

food for thought..most wars are over resources..

401